Emerging Trends in the International Relations Arena

by SYED DANISH ALI

This article sheds light on emerging risks and trends in the International Relations arena. It is recognized that International Relations is a far more complex and perplexing area that we might give credit to. There is the thought of what might happen, the actual actions, and the image and perceptions of those actions. The wheel of causality does not necessarily roll between them in a manner conducive to our understanding. However analyzing processes rather than results might allow us to reach a framework, albeit simplistic, regarding probable emerging risks in International Relations.

This article undertakes an exploratory process-grounded expedition into three possible emerging risks:

- Shale oil causing seismic upheavals in the politics of the Middle East

- Why are terrorist organizations so hard to eliminate

- Big data implications on International Relations

Shale oil causing seismic upheavals in the politics of the Middle East

For analyzing impact of shale oil on International Relations, the Middle East is chosen as a case in point because it appears to be the most affected region by provocations of shale oil. The Middle East operates a complex calculus in its International Relations and dealings with the rest of the world. Politics, diplomatic relations, economic and social institutions are strategically based on resources and commodities. Because of the onslaught of shale oil, the established calculus for International Relations seems to be facing seismic upheavals in the Middle East with new unprecedented trends possibly emerging. While shale oil reserves have been discovered in many countries, they have been primarily actualized in the United States of America so far. Whereas speculation for evident results of shale oil is commonly made, there might be a lack of sufficient focus on processes. Analyzing processes enables us to see the underlying factors causing the movements, and therefore unexpected results which may appear in the future could be explained if there is an underlying process-grounded strategy for handling the shale oil reserves issue. In particular, we analyze the question of whether or not the shale oil reserves signaled a point of no return for the political landscape of the Middle East?

Impact of shale oil on the economics of the Middle East

Financial consequences have so far been severe. Over the past few months, there has been a frenzy growing within OPEC cartel to do something about the alarming fall in oil prices. There was conflict over whether the members could unite to decrease supply so as to push oil prices up. The leading member, Saudi Arabia, stood up, reciprocating the stance that the supply cut had to be mutually determined, and that Saudi Arabia would not act in isolation to reduce its oil supplies. Since the shale oil conquest, OPEC meetings have become excruciating for its members[1].

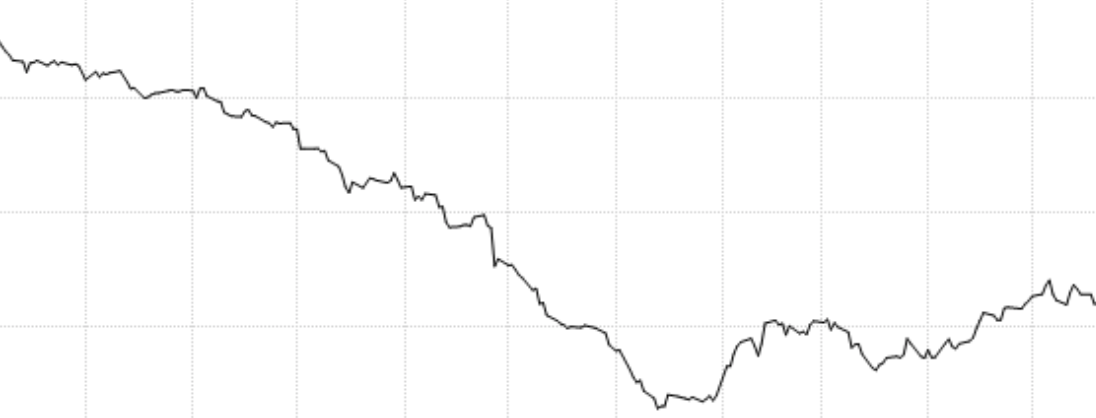

The all-too evident impact of shale oil on oil prices can be encapsulated by the following illustration:

As can be seen, oil prices (Brent) have fallen consistently by about 50% over the past year. This is given the fact that Saudi Arabia needed oil prices to average USD 99 per barrel to balance its budget for the year, which is exceedingly higher than the current trading price of oil[2]. The IMF warned GCC countries a few months ago of USD 175 billion losses that their fiscal budgets might have to sustain due to falling oil prices[3]. The estimated losses might have escalated profoundly by now.

High oil prices seemed to be necessary for both Middle East and America. While the Middle East needed high oil prices to sustain its governments’ budgets, shale oil also required high oil prices to cover its significantly expensive production costs. There should have been a collusion by both US and the Middle East to sustain high oil prices.

However, recent experience proved otherwise. Saudi Arabia signaled that it would be ready for significantly lower prices for sustained period of time, possibly around two years[4]. This was a ‘checkmate’ attempt to try to halt the aggressive expansion of US shale oil supplies by not being able to cover the expensive production costs. Many other numerous and divergent reactions have surfaced from both sides as well by now.

With no sign of relenting in the expansion in shale oil supplies, British Petroleum (BP) estimated that the United States will become energy self-sufficient by 2035 and North America by 2018[5]. Also, the US became the world’s top producer of oil in 2014, surpassing both Saudi Arabia and Russia[6].

Shale oil is restructuring political dynamics of the Middle East

Shale oil does not have implications on just oil prices. In the upcoming medium to long run, the US and Middle East might come up with mutually beneficial pricing structure and levels. The crucial impact is on rapid redundancy of US’s energy demands from the Middle East. Shale oil has become the major bargaining chip through which the US can potentially dominate the policy talks in the oil exporting Gulf countries.

The Carter Doctrine leads the way to US presence in the Middle East so that regional conflicts do not convert into shortages of oil supplies for the US, which is crucially dependent on Middle East for its energy needs. This doctrine is likely to become less important for US foreign policy as US is aggressively progressing to energy self-sufficiency. There are strong reasons, though, that would allow for continued US existence in politics of Middle East, chiefly terrorism and regional conflicts (recent war in Yemen being the leading example). There are also the after-effects of the Arab Spring and there seems to be no relief from the rise of popular and growing civil dissent in the Middle East. It might seem unnecessarily pessimistic, but policymakers might benefit from inquiring about the fact that the Middle East might not be able to play the oil card as effectively as it could up to pre-shale era, and asking how sure is it that the US will persistently continue the same intensity of support it provides to counter terrorism and civil dissents over the long term.

How will the Middle East respond to sustain its oil sales in the long term? BP forecasted that by 2030, China is likely to become the world’s single largest oil importer, relying on imports for almost 80% of its oil .Europe, over the same period, is likely to keep its stance as a large importer of fossil fuels[7]. However, China has the world’s largest reserves of shale oil, estimated by U.S Energy Information Administration (EIA) to be at 1,115 Tcf[8] and therefore it might only be a matter of time before China invests heavily in this direction and frees the barriers that are currently prohibiting it to exploit these shale oil reserves. Europe has seemingly better relationships with the US than the Middle East, and therefore might turn more to US for shale oil supplies to meet energy demands and reduce the dependence it has on Russia and Middle East.

Policy recommendations

The Middle East governments are cognizant of the fact that they suffer from profound concentrated risk of dependence on oil revenues for sustaining their economies. Economic hits might amplify the social problems that the Middle East faces as well. But there is inspiration in seeing UAE as a case-in-point for diversifying its economies. Dubai is the best example of a city climbing to the top world-leading position and UAE also has the most diversified economy within GCC countries. Middle East might benefit from recognizing that ‘tic-for-tac’ responses have the potential danger of spiraling into a vicious cycle that might actually hasten up persistent collapse of oil prices. No doubt Middle East has to take account of short-term dynamics to curtail the onslaught of shale oil, but any sustainable success will likely be brought about by balancing the sustainable objectives of the long term with the constraints of the short term.

Why are terrorist organizations so hard to eliminate?

Framework of network analysis of terrorism reveals that terrorist factions are sticky to eliminate as they form other more radical groups and diffuse easily into the populations. Terrorist groups are not solely dependent upon strong sentiments and radical ideologies for their continued existence; rather they fill in the power vacuum and prey on the wretched social disparities (poverty, corruption, marginalization etc) that exist from which they recruit the majority of their combatants in, for example, Iraq and South Asian countries. They are also relatively easy to set up and their speed of diffusion and infiltration into a society or region allows them to be more responsive than the counter-terrorist parties. Their increased involvement in politics of turbulent regions is a cause for serious concern in Iraq, Syria and Pakistan. The enhanced fusion of terrorists in politics in recent times creates a murky, tangled web where it becomes quite difficult to be able to separate the wheat from the chaff. While inherently relying on total obedience internally, they thrive on murky waters of uncertainty in the external environment which turbulent politics and internal dissent readily provide.

Big data implications on International Relations

All around the world, we find praise being showered for big data. This data revolution is perhaps simplistically assumed to bring countless benefits to humanity and to result in quantum leaps in standards of living. Thinkers and intellectuals in International Relations are more realistic in their assessment. History is a glaring example that technology has almost always increased the scope of our conflicts with other powers and states. Big data is proceeding at an unstoppable pace to create and strengthen what Foucault termed ‘the surveillance society’. This is the society of today’s postmodern world, where we have a constant feeling of being watched. Our own minds become the police which brings about a very silent, hidden yet effective method of gaining habitual obedience.

Even if we discount the massive invasions of privacy, big data has upgraded the level of data thefts and hacking both across companies and countries. Intelligence divisions’ focus on data is unlike it has ever been before. Data leaks have increased due to these developments which reduce the capacity of foreign policymakers to make an impact. This is because if confidential information on intelligence and correspondences between diplomatic parties is made prominent to the internet via data leaks, then it strictly limits the efficacy of those strategies.

There appears to be more and more reliance on digital storage for information. While big data can allow the data to be analyzed more diversely, it also has the capacity to uncover uncomfortable and unethical truths about our behavior and behavior of rival countries and regions. Are we prepared to handle the big data revolution and commit it to peace or will we rather overhaul the level of our conflicts? This glaring question is posited to us with history as witness. May we hopefully realize the gravity of this emerging situation.

Conclusions

In conclusion, it is hoped this article has been able to explore the evolving issues in International Relations and help to lessen the fog which hopelessly surrounds the landscape of world politics. It is also meant to contribute fruitfully to the current existing dialogue on emerging risks and trends in International Relations.

[1] Wall Street Journal (Nov 16, 2014), Summer Said. http://online.wsj.com/articles/falling-oil-prices-test-opec-unity-1416188605

[2] Reuters (Nov 18, 2014), Barani Krishnan. http://www.reuters.com/article/2014/11/18/markets-oil-idUSL3N0T81XP20141118

[3] The National ( Oct 27, 2014), Frank Kane. http://www.thenational.ae/business/economy/imf-warns-gcc-countries-of-175-billion-hole- created-by-falling-oil-prices

[4] Reuters (Oct 13, 2014), Bousso and Schneyer. http://www.reuters.com/article/2014/10/13/us-oil-saudi-policy-idUSKCN0I201Y20141013

[5] Reuters (Jan 15, 2014), Lawler and Eisenhammer. http://uk.reuters.com/article/2014/01/15/uk-bp-energy-idUKBREA0E1B820140115

[6] Bloomberg (July 4, 2014), Grant Smith. http://www.bloomberg.com/news/articles/2014-07-04/u-s-seen-as-biggest-oil-producer-after- overtaking-saudi

[7] Energy Post (Jan 10, 2014), Christof Ruhl. http://www.energypost.eu/five-global-implications-shale-revolution/

[8] EIA (Feb 4, 2014). http://www.eia.gov/countries/cab.cfm?fips=ch